With our end-to-end integrated Sales Platform, we are transforming the retail experience for players in the automotive industry with a suite of products that deliver for all your automotive requirements. Whether you’re an OEM, franchise or independent dealer, we help you drive the end-to-end strategy required to win in today’s environment.

Next-Gen Solutions to Thrive in a Digitised Automotive Marketplace

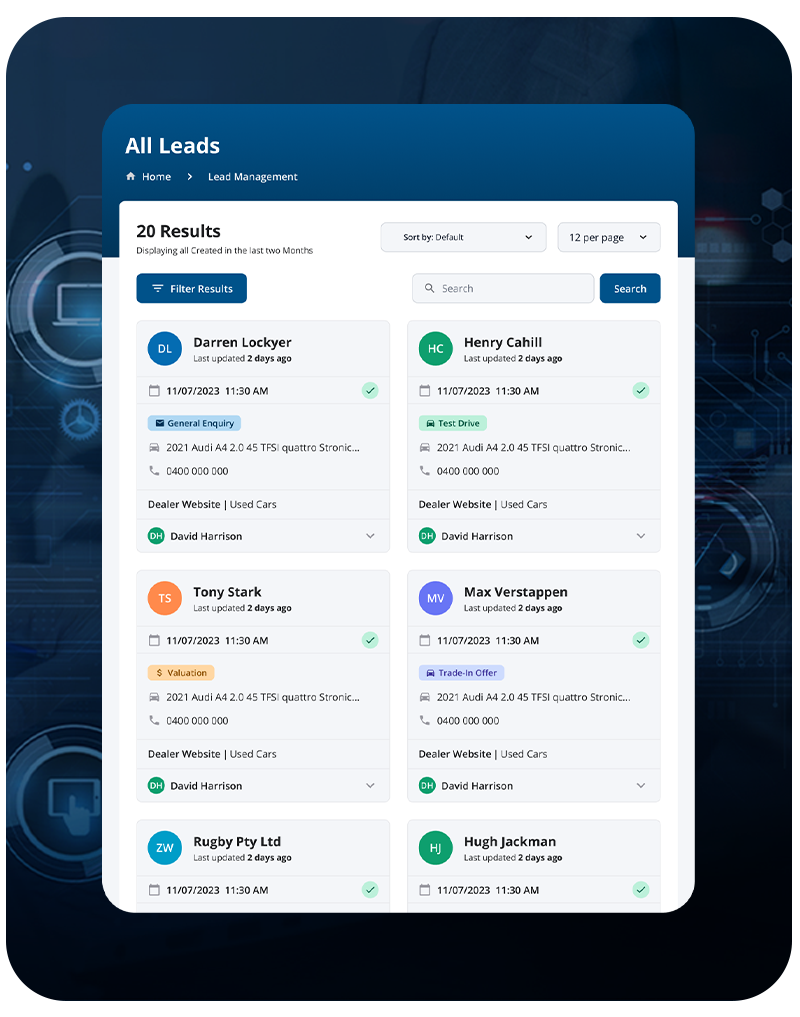

Lead Generation

Lead Optimisation

Customer Retention

Showroom Conversion

Our Partners

We help you drive the end-to-end strategy, people, process and technology transformation required to adapt and win in today’s automotive industry environment successfully.

Next-Gen Solutions to Thrive in a Digitised Automotive Marketplace

Market Insights Report

A look at 2023

This report is a snapshot of the used vehicle market performance and provides information on buyer behaviour for August and September 2022 compared to the previous year. The used vehicle market insights are sourced from our Market Insights and Valuations platforms, AutoRadar and Kelley Blue Book.

FAQs

What types of software do dealerships use?

At Cox Automotive, you’ll find the best software for car dealers to support your business with end-to-end, all-in-one solutions. You can take advantage of everything from managing inventory, pricing, maximising leads and advertising and managing your customer relationships. Some of our premier services include:

- Website design and development — Today’s car market is very fractured, between shopping at car yards, print and online classifieds and consumer-to-consumer. We design and build websites that rank and help you showcase your range to new potential customers wherever they are.

- Trade-In Offer – Our Trade-In Offer dealership software is a direct way for dealer groups, franchises and distributors to source cars whilst providing an easy-to use instant trade in offering.

- AutoRadar — Centralising vehicle valuations, inventory analysis and live market reporting, AutoRadar is a dynamic dealership software that allows you to collect used car data to optimise your pricing strategies and make informed decisions for your dealership.

- Xtime — Our Xtime car dealer software helps manage your workflows and gives your customers a more personalised service. Between DMS integrations, managing appointments and text message reminders, your customers can self-check-in and feel more included and informed.

What's an automotive CRM?

Automotive CRMs are technology platforms your businesses can leverage to increase department collaboration and efficiency to create a seamless and more personalised customer experience. From managing accounts, DMS integrations, maintaining compliance, and in some cases, customer financing, software for car dealers will help your dealership get the most out of each function.

By reducing friction at pain points, Cox Automotive’s car dealer software will help your automotive business reduce customer acquisition costs, organise your sales team and create a smooth end-user experience.

Why do automotive businesses need software solutions?

The best software for car dealers gives your business a bird’s eye view of your short and long-term operations. They allow you to track bottlenecks and underutilised services to optimise your offerings and increase efficiency and savings. With active utilisation of our dealership software platforms, you can remove barriers between business functions to increase collaboration, efficiency and savings to maximise your margins.

What are the benefits of dealership software?

Software for car dealers isn’t just another service for your staff to use — they are the backbone of your business. There are many benefits to using Cox Automotive’s services, including:

- Maximise lead generation and evaluate advertising success — Car dealerships are huge marketers and advertisers, investing in a wide range of resources to drive referrals and conversions. Using our dynamic software solutions, you can better qualify leads and identify which channels deliver the most significant value for your business, increasing sales and reducing customer acquisition costs.

- Integrate customer communications — Across one setting, you can record your communications to create a customer profile detailing their needs. You can also see what services and unique, personalised offers have been extended to existing customers. These allow you to manage their expectations and will enable you to cross-sell between different products and services.

- Centralise customer accounts — Document and record customer activity in one place. Mark what vehicle they own with details listing when they last serviced their car, identify if a part has been recalled and establish their loyalty to the business. This information can be used to extend special offers to incentivise repeat sales.

The best software for car dealers gives your business a bird’s eye view of your short and long-term operations. They allow you to track bottlenecks and underutilised services to optimise your offerings and increase efficiency and savings. With active utilisation of our dealership software platforms, you can remove barriers between business functions to increase collaboration, efficiency and savings to maximise your margins.

Have a question?

We’re here to help! Learn more about Cox Automotive products and solutions by completing the form and our team will be in touch.

Call us on 1300 66 11 33

"*" indicates required fields